From the time the first website was published in 1991 until today, the internet has profoundly reshaped humanity.

Comparisons between cryptocurrencies and the growth of the internet are invariably drawn (including cryptocurrencies’ netscape moment); however, I wanted to test this comparison and see exactly how far along we are.

In this post, I’ll also be exploring the growth of the cryptocurrency market & the early growth of the internet, to see what takeaways we can uncover.

What makes this comparison tough

It’s impossible to know exactly how many people use cryptocurrency and how often because:

- For people who self custodial their cryptocurrencies — people can have multiple wallets for different cryptocurrencies.

- For people who store their cryptocurrencies on exchanges — 1 wallet address does not equate to 1 user on the exchange. It’s also typical for exchanges to create a wallet address for each transaction.

Thus, the only way to get an understanding of the number of users for cryptocurrencies is through approximations.

Measuring cryptocurrency user growth

I tried to approximate cryptocurrency user growth in a few ways:

- Bitcoin & Ethereum wallet growth

- Bitcoin & Ethereum active addresses growth (proxy for DAU)

- User growth of crypto-fiat and crypto-crypto exchanges

- Total cryptocurrency trading volume over time

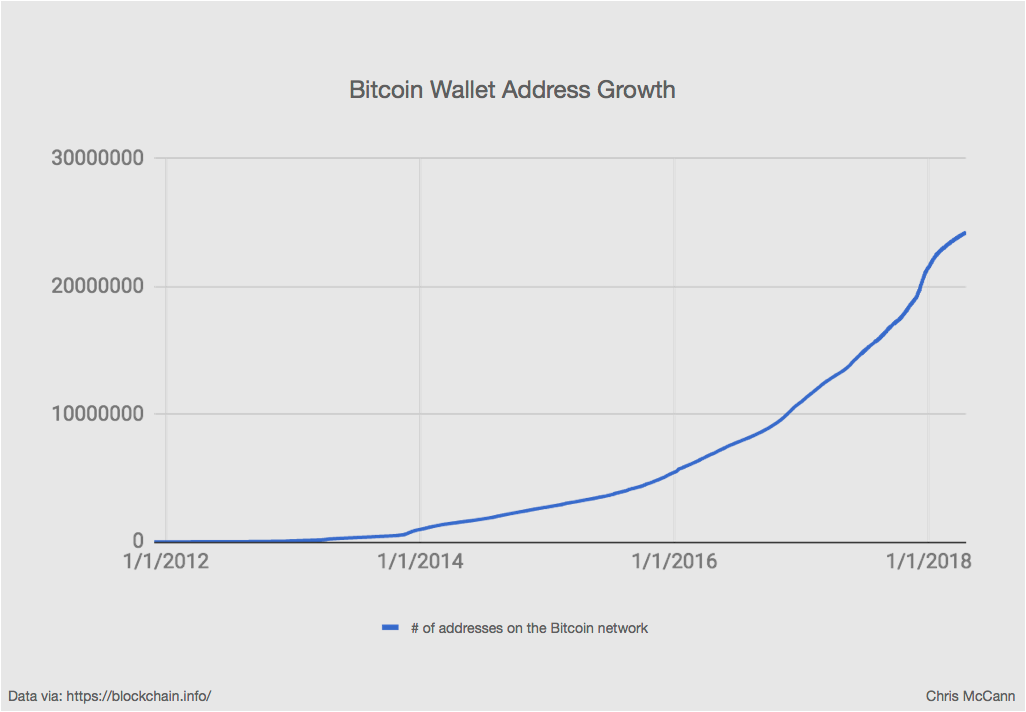

There are ~24M bitcoin wallet addresses in total. This doesn’t mean there are 24M Bitcoin users because one person can have more than 1 wallet address and it is recommended to generate a new bitcoin address for each transaction sent.

I would consider 24M the upper bound number on the number of bitcoin users worldwide.

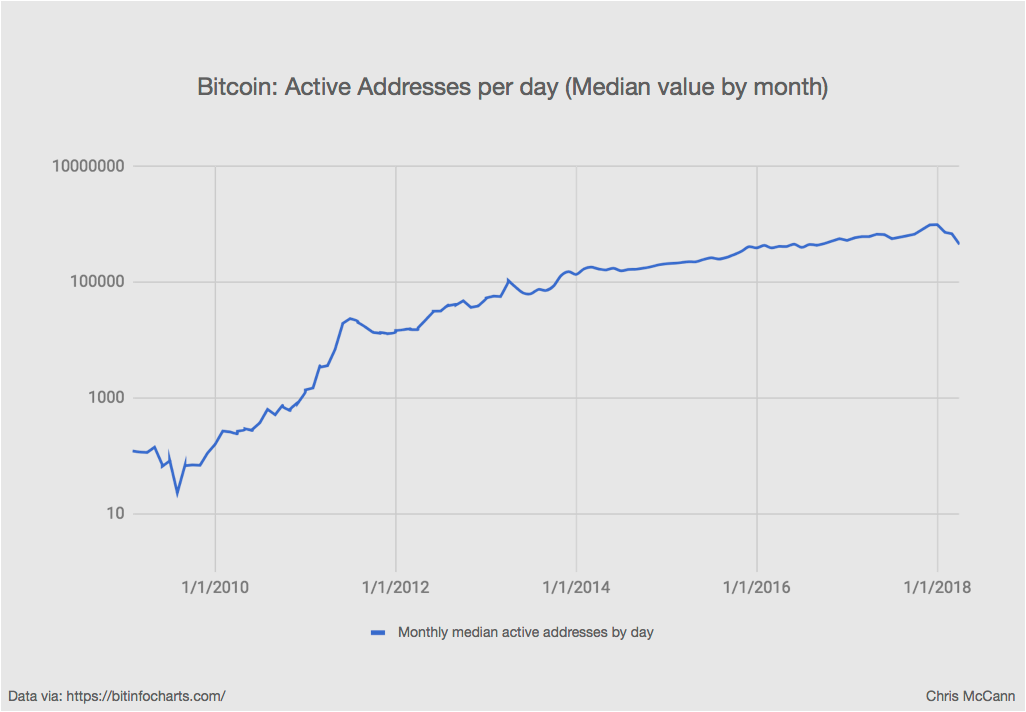

In addition to looking at the number of wallets, we can look at the number of active addresses per day. To smooth out this chart, I took a median value of active addresses by month, and plotted it on a log scale:

The highest amount of active addresses we’ve seen per day was ~1.1M addresses — this is an approximation of daily active users (DAU) within the bitcoin network. However, if the main point of Bitcoin is viewed as purely a store of value, then you would assume a much lower DAU vs. any traditional mobile application or website.

Source/More: 12 Graphs That Show Just How Early The Cryptocurrency Market Is